Business inventories and GDP are more closely linked than many realize, forming a dynamic relationship that can reveal the health and direction of entire economies. By delving into how companies manage their stockpiles of goods and how those decisions ripple through national output, readers gain a fresh perspective on the real drivers of economic cycles.

From the warehouse floor to the GDP charts, this topic uncovers the fundamentals of inventory management, the vital connection to gross domestic product, and the impact of inventory shifts during both booms and downturns. Through case studies, strategy breakdowns, and an exploration of policy impacts, you’ll see how inventory practices are not just a business concern but a key piece in the puzzle of economic growth and stability.

Understanding Business Inventories and Their Economic Significance

Business inventories are crucial assets for companies across all sectors. They represent goods that are held in stock to support production, sales, and operational continuity. Effectively managing these inventories not only impacts a company’s bottom line but also plays a considerable role in the broader economic landscape, influencing metrics such as Gross Domestic Product (GDP).

Types of Business Inventories and Their Roles

Business inventories are generally categorized into three main types: raw materials, work-in-progress (WIP), and finished goods. Each type supports different stages of the production and sales cycle, and their management can vary significantly by industry. Understanding these categories provides insight into how businesses balance cost, efficiency, and demand.

| Type | Example Industry | Purpose | Impact on Operations |

|---|---|---|---|

| Raw Materials | Automotive Manufacturing | Supports production schedules by ensuring material availability | Delays can halt production, affecting output and delivery |

| Work-in-Progress (WIP) | Electronics Assembly | Represents goods partway through manufacturing | Too much WIP can tie up capital and slow completion |

| Finished Goods | Retail & Consumer Goods | Ready for sale, meets customer demand directly | Overstock leads to discounts; understock risks lost sales |

Inventory Management Practices Across Industries

Managing inventory efficiently is essential for cost control, customer satisfaction, and operational agility. Different industries adopt unique inventory management methods based on product type, demand variability, and supply chain complexity.

- Manufacturing companies often use Material Requirements Planning (MRP) to synchronize raw material orders with production schedules.

- Retailers rely on demand forecasting and just-in-time (JIT) inventory systems to reduce excess stock while meeting customer needs.

- Pharmaceutical firms maintain higher inventory levels due to strict regulatory requirements and unpredictable demand surges.

- Tech firms, especially those facing rapid product obsolescence, prioritize lean inventory strategies to minimize holding obsolete goods.

The Relationship Between Business Inventories and Gross Domestic Product (GDP)

Business inventories are not just internal metrics; they have a direct and measurable impact on GDP calculations. Shifts in inventory levels can signal changing economic conditions and influence how national economic growth is interpreted.

Influence of Inventory Changes on GDP Growth Rates

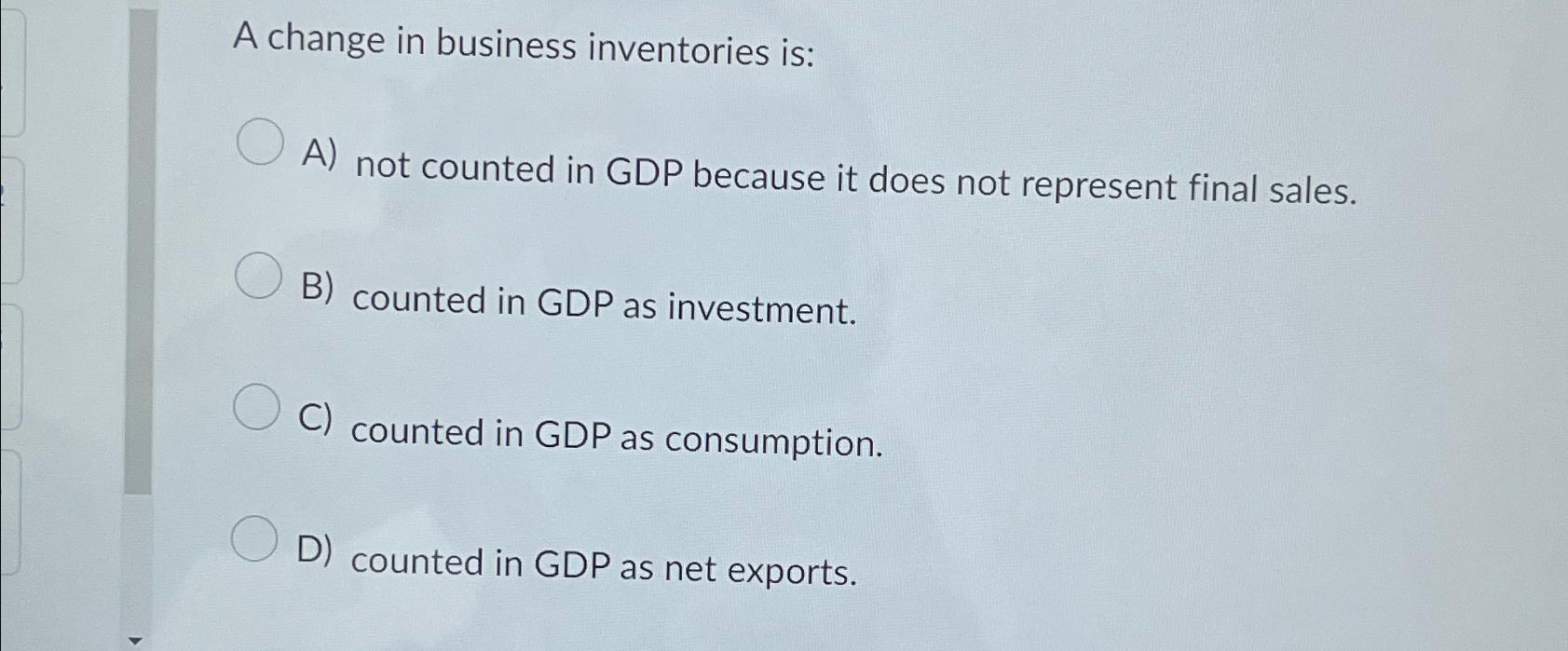

GDP comprises multiple components, and inventory investment is a critical factor. When businesses increase their inventories, it is counted as an investment and boosts GDP. Conversely, a decrease in inventories subtracts from GDP, reflecting slower production or sales expectations.

Inventory investment is one of the most volatile components of GDP, often amplifying the ups and downs of business cycles.

Inventory Investment in GDP Calculations

The change in inventories, known as inventory investment, is included in the calculation of GDP under the “Investment” category. It reflects the net addition or depletion of goods businesses hold in stock during a given period.

| Step | Description | Impact on GDP |

|---|---|---|

| 1 | Measure beginning and ending inventories for the period | Calculates inventory change |

| 2 | Determine the net change (ending – beginning) | Positive net change adds to GDP, negative subtracts |

| 3 | Include in GDP investment calculation for the quarter/year | Final GDP figure reflects inventory trends |

Historical Examples of Inventory Fluctuations Affecting GDP

Major shifts in inventories have historically coincided with significant economic events. These fluctuations can either cushion or amplify economic swings depending on the context.

- In 2008, rapid inventory liquidation during the financial crisis led to a sharp contraction in GDP.

- Early in the COVID-19 pandemic, widespread supply chain disruptions and panic-driven inventory accumulation caused erratic inventory investment patterns, contributing to GDP volatility.

- Post-World War II, restocking of inventories as economies reopened created a surge in GDP growth rates.

Economic Indicators and Inventory Trends

Monitoring business inventories provides important clues about the direction of the broader economy. Key indicators, such as inventory-to-sales ratios and inventory trends during economic cycles, are closely tracked by analysts and policymakers.

Leading Economic Indicators from Business Inventories

Inventory data is often considered a leading indicator because changes frequently precede shifts in economic growth. Surges in inventories may indicate over-optimism, while rapid depletion could signal future production increases.

- Inventory-to-sales ratio: A rising ratio often signals slowing demand, while a declining ratio indicates strong sales or lean inventory management.

- Manufacturers’ and retailers’ inventories: Tracking these helps identify supply chain bottlenecks and potential growth or recession signals.

Inventory-to-Sales Ratios and Economic Cycle Implications, Business inventories and gdp

The inventory-to-sales ratio is a widely used metric to monitor economic health. Fluctuations in this ratio can foreshadow transitions between growth and contraction in the economy.

- High ratios typically occur before or during recessions, reflecting unsold goods and cautious purchasing.

- Low ratios are common during expansions, as strong sales outpace replenishment.

Comparing Inventory Trends in Recession and Expansion Periods

Inventory management strategies shift based on the economic environment. The following summary Artikels typical inventory patterns during different phases of the business cycle.

- During recessions, businesses cut back on production and allow inventories to fall, reducing investment and potentially deepening GDP declines.

- In periods of expansion, firms rebuild inventories to meet rising demand, contributing positively to GDP growth.

In the early 2000s, a sharp drop in technology inventories provided an early warning of the dot-com bust, signaling an imminent economic slowdown before other indicators caught up.

Last Point

Exploring the relationship between business inventories and GDP shows how pivotal inventory management is not just within companies, but across the broader economy. Understanding these connections helps businesses, policymakers, and observers anticipate changes, respond with agility, and drive more resilient growth as new challenges and technologies continue to emerge.

Question & Answer Hub: Business Inventories And Gdp

What are business inventories?

Business inventories are the stock of goods and materials that companies hold to support production, sales, and operations, including raw materials, work-in-progress, and finished goods.

How do business inventories affect GDP?

Changes in business inventories are a component of GDP calculation. Increases in inventories add to GDP, while decreases can reduce it, reflecting shifts in production and demand.

Why do companies use methods like FIFO or LIFO for inventory?

Companies use methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) to value inventory, manage costs, and match accounting practices to their operational needs and market conditions.

Can inventory levels predict economic recessions?

Yes, significant changes in inventory levels—such as sudden build-ups or rapid drawdowns—can signal economic slowdowns or recoveries, acting as early indicators of business cycle turns.

What is the inventory-to-sales ratio?

The inventory-to-sales ratio measures the amount of inventory held relative to sales, helping businesses assess efficiency and potential market trends.